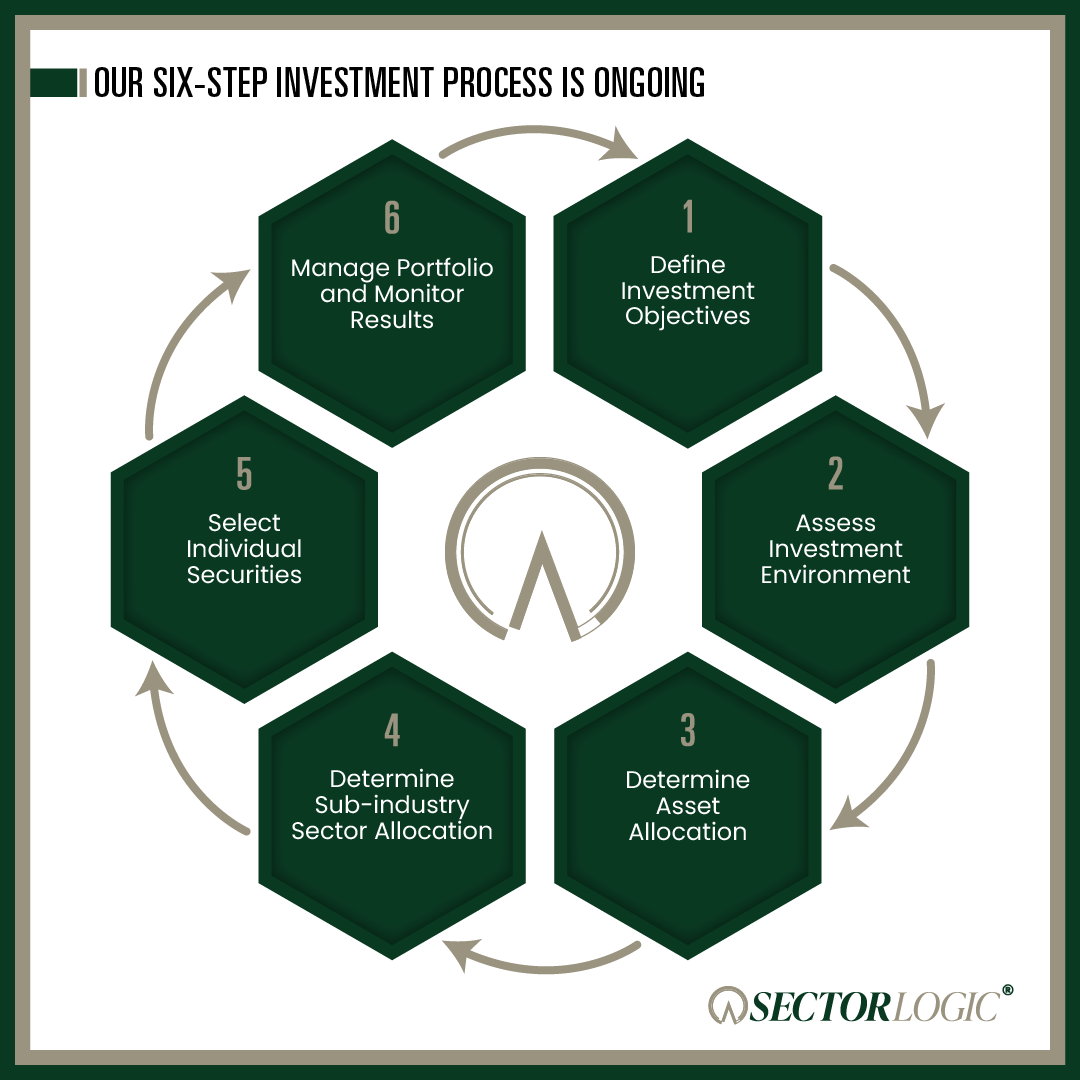

Investment Process

Our investment approach uses a disciplined process that helps you identify your personal investment goals. We employ a defined process for each critical step in the investment management cycle, including goal setting and risk tolerance evaluation, investment environment assessment, asset allocation modeling, sub-industry sector allocation, individual security selection, monitoring, and comprehensive reporting.

Step 1

Define investment objectives

Our Investment Advisor Representative will meet with you to discuss your investment objectives and risk tolerance. We realize that every client has a unique set of investment requirements. Our investment process begins right there, gaining an understanding of where you are today and where you want your investments to take you. We look at your tolerance for risk, tax considerations, investment time horizon, current and future income requirements, and investment return objectives. We develop an investment plan specifically for you.

Step 2

Assess Investment Environment

Sector Logic's investment approach incorporates the best of both worlds. First, our investment strategy utilizes a top-down approach. We monitor and evaluate thousands of proprietary indicators in the five critical areas: economic, monetary, financial, political, and market psychology. Our objective is to ascertain the expected return and the probability of outperformance for each asset class. Second, we use a bottom-up approach to identify sub-industries with attractive valuations and superior business momentum. We believe the combination of these methods provides us with a distinct advantage.

Step 3

Determine asset allocation

To construct each client's portfolio, Sector Logic first creates an overall asset allocation strategy based on expected asset class returns, probability of outperformance, and risk measurements. Our proprietary tactical asset allocation models drive our tactical asset allocation decisions, which increase or decrease stock, bond, or cash exposure. Our disciplined valuation-based tactical asset allocation approach is designed to improve the probability of identifying asset class opportunities. By using our tactical asset allocation strategy, we seek to enhance expected returns and reduce downside risk.

Step 4

Determine Sub-Industry Sector Allocation

We evaluate sub-industry sectors based on company and industry fundamentals, and current market trends. Sector Logic analyzes, evaluates, and ranks approximately 140 sub-industries weekly in order of potential for price appreciation. We seek to identify sub-industries with attractive valuations, and strong and improving business momentum. This includes sub-industries with strong and accelerating earnings growth, improving profitability, and relatively strong stock price performance. We believe these sub-industries represent superior investment opportunities. By incorporating relative strength into our methodology, we select holdings that are outperforming alternatives. We regularly rotate portfolio holdings as new leaders emerge in response to changes in market and economic conditions.

Step 5

Select Individual Securities

After analyzing capital market opportunities, we carefully review your investment alternatives and select specific issues for your portfolio. These include individual stocks, bonds, mutual funds, exchange-traded funds (ETFs), or other investment vehicles. Current capital market opportunities and your objectives determine the mix and selection.

Step 6

Manage Portfolio and Monitor Results

We constantly evaluate our indicators and client portfolios. Your portfolio will be monitored on an ongoing basis to ensure it remains on track to achieve your investment goals and objectives. We communicate with you regularly and provide you with a quarterly review of your portfolio.

The process begins and ends with you

The six steps are repeated continuously to ensure the best results, and to keep you completely informed on the performance of your portfolio.