What is Sub-Industry Sector Rotation?

The stock market fluctuates between periods of growth, decline, and stability. Regardless of the market's direction, specific economic or sub-industry sectors often outperform others. These sectors tend to follow distinct cycles, meaning that last year's underperformers might be this year's market leaders. Sub-industries are influenced by various factors, such as the business cycle, interest rates, government policies, and commodity prices, causing their performance to vary widely.

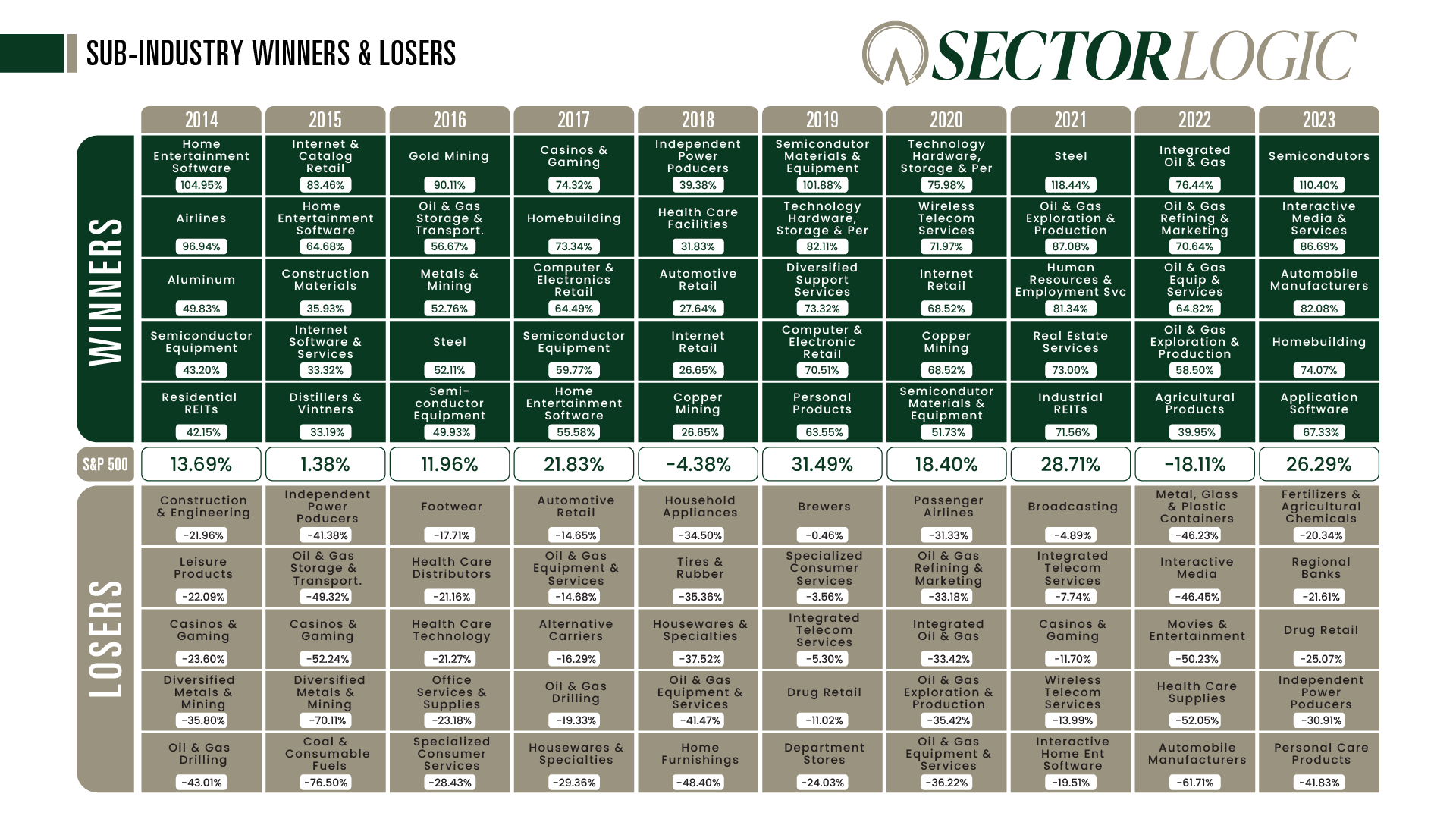

For example, from 2014 to 2023, the top five performing sub-industries delivered an average annual return of 64.4%, compared to the S&P 500's average annual return of 15.1%. In contrast, the bottom five sub-industries generated an average annual return of -32.0%. This divergence presents significant investment opportunities for those who can capitalize on these trends.

DISCLAIMER: This material is for illustrative, educational, and informational purposes only and may be subject to change. It is not intended as research, investment advice, or a recommendation for any specific products, strategies, or securities. The information provided is general in nature and does not consider individual financial circumstances. It should not be used as the primary basis for investment decisions. Before making any investment decisions, consider consulting a financial professional to assess the suitability of the information to your personal situation. Performance data is based on back-tested results of non-investable indexes. No strategy or methodology guarantees future outcomes, and all investments carry the risk of loss. Past performance does not guarantee future returns, and investors cannot invest directly in an index. The table displays annual total returns, including reinvested dividends, for the top five and bottom five performing sub-industry sectors over the past ten years, ranked by performance. All sub-industry indices are based on the MSCI S&P 500 Global Industry Classification Standard (GICS). As of March 23, 2023, the S&P 500 index comprised 11 sectors and 163 sub-industries, representing the U.S. stock market"

Sector Logic’s Rotation Methodology

At Sector Logic, our sector rotation strategy is underpinned by a rigorous quantitative analysis. We meticulously evaluate companies with strong business momentum, including robust earnings growth, improving profitability, and attractive valuations. This comprehensive approach involves analyzing and ranking around 140 sub-industries weekly, identifying those with the highest potential for price appreciation over the next 3-12 months.

Our process is unique because it evaluates sub-industries based on fundamental factors and current market trends. By focusing on companies with attractive valuations, solid fundamentals, and high relative stock price strength, we aim to identify the sub-industries that will likely outperform for an extended period. We maintain a disciplined approach in adjusting portfolio holdings as new leaders emerge in response to changing market conditions. This disciplined approach is a cornerstone of our risk management strategy, ensuring we manage risk while pursuing returns.

Identifying Opportunities

There’s an old saying on Wall Street: “A rising tide lifts all boats.” When a sub-industry is performing well, many of the stocks within that group will benefit. Studies show that 60% of a stock’s price movement can be attributed to economic, market, and sub-industry factors, while the remaining 40% is influenced by company-specific issues.

Sector Logic’s methodology identifies sub-industries with strong business fundamentals and attractive valuations, increasing the likelihood of benefiting from economic developments. We also seek sub-industries with strong stock price performance to capitalize on current market trends.

Reducing Risk

At Sector Logic, we elevate sector rotation by focusing on investing in the right sub-industries at the right time. Our disciplined strategy seeks to minimize risk by avoiding sub-industries with a higher probability of underperformance. By relying on a systematic process, we aim to reduce the investment risks associated with emotional decision-making, ensuring a more consistent and objective approach to sector investing.

Our Ten Investment Strategies

Cash Flow Kings

This strategy targets stocks within the sub-industries, generating high cash flow yields and strong relative stock price performance.

Value Investor

This strategy seeks to identify stocks within sub-industries that are trading at relatively attractive valuations, using a composite of valuation metrics. By focusing on undervalued companies, the strategy aims to uncover opportunities where the market may be underestimating the true value, offering the potential for significant appreciation.

Value on the Move

This strategy targets stocks within sub-industries that not only trade at relatively attractive valuations based on a composite of valuation metrics but also exhibit strong relative stock price performance. By focusing on undervalued companies that are gaining market momentum, the strategy seeks to uncover opportunities where both valuation and price action suggest potential for significant appreciation.

RevUp Momentum

This strategy emphasizes stocks within sub-industries selling at a substantial discount to their revenues and strong relative stock price performance

Pursuing Profitability

This strategy focuses on stocks within sub-industries that are generating high returns on equity, adjusted for current valuations, while also demonstrating strong relative stock price performance. By targeting companies that combine profitability with market momentum, the strategy seeks to identify investments with the potential for superior long-term returns.

Capturing the Trend

This strategy targets stocks within sub-industries that are demonstrating strong relative stock price performance. By focusing on companies with significant upward momentum, the strategy aims to capitalize on prevailing market trends and identify opportunities for continued growth.

Seeking Growth

This strategy targets stocks within sub-industries that generate high free cash flow yield and show strong relative stock price performance. By focusing on companies that combine robust free cash flow generation with market momentum, the strategy aims to identify growth opportunities with the potential for substantial returns.

Pursuing Prudent Profitability

This strategy focuses on stocks within sub-industries that exhibit high profitability relative to their total capitalization, while also showing strong relative stock price performance. By targeting companies that balance strong financial returns with market momentum, the strategy seeks to identify prudent investment opportunities with the potential for sustainable growth.

Finding the Next Reversal of Fortune

This strategy targets stocks within sub-industries that have experienced prolonged periods of underperformance but are now showing signs of a turnaround, with strong relative stock price performance. By identifying companies poised for recovery, the strategy seeks to capitalize on potential reversals of fortune and uncover opportunities for significant gains.

Bargain Buyers' Momentum

This strategy focuses on stocks within sub-industries that are trading at attractive valuations relative to their book value, while also demonstrating strong relative stock price performance. By combining value investing with momentum, the strategy aims to identify undervalued companies that are gaining market traction, offering the potential for significant gains.