Sub-Industry Sector Stories

2023 – Semiconductors and Artificial Intelligence

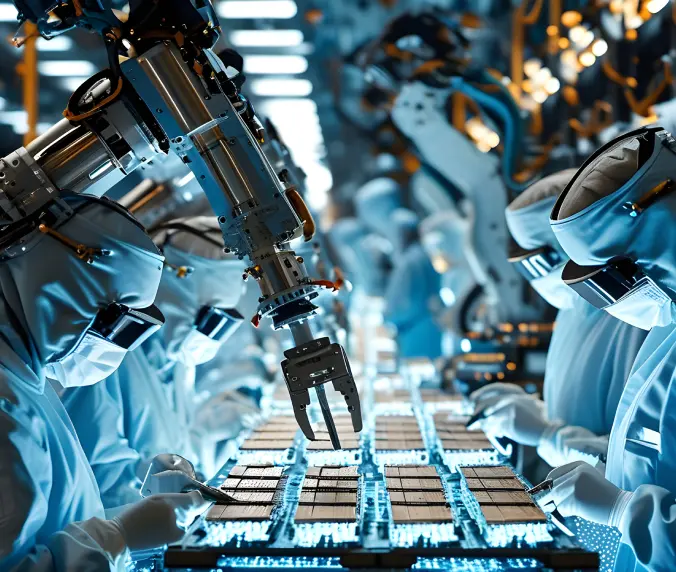

In 2023, artificial intelligence (AI) technologies unleashed the full potential of advanced semiconductor design, driving a surge in innovation and investor demand for semiconductor stocks. The recovery of global supply chains allowed semiconductor companies to meet rising demand in key sectors like automotive and cloud computing. Increased government support, such as the U.S. CHIPS Act, boosted domestic production and confidence in the industry. Semiconductors also benefited from innovations in chip design and energy efficiency, keeping them competitive in evolving markets. Strong earnings growth across these areas contributed to the sector's robust stock performance. In 2023, the S&P 500 Semiconductor sub-industry index produced 110% gains.

2022 - Integrated Oil and Gas

Integrated oil and gas stocks soared in 2022 as rising oil prices, tight supply, and a focus on shareholder returns made energy the S&P's top-performing sector. During 2022, oil prices rose, driven by the Russian invasion of Ukraine, and tight supply from OPEC. The global recovery from the pandemic led to a surge in demand, while supply remained constrained, pushing prices higher. Additionally, many companies exercised capital discipline by focusing on shareholder returns through dividends and share buybacks rather than new investments. The S&P 500 Integrated Oil and Gas sub-industry index generated returns of 76% in 2022.

2021- Steel

Steel stocks delivered exceptional returns in 2021, with the S&P 500 Steel sub-industry index surging 118% as steel prices skyrocketed due to supply chain disruptions and strong demand. The global economic rebound fueled increased demand from construction and manufacturing, while President Biden's $1 trillion infrastructure plan in the U.S. added further momentum. Meanwhile, China's push to cut steel production to reduce carbon emissions tightened global supply, driving prices even higher. With rising commodity prices and inflation concerns, steel stocks became a hot commodity for investors, leading to impressive gains throughout the year.

2020 - Technology Hardware, Storage, and Peripherals

With the right technology hardware, storage, and peripherals, you can work from anywhere, and in 2020, that became a reality. The Technology Hardware, Storage, and Peripherals sector surged as the pandemic-driven shift to remote work and learning sparked a spike in demand. Increased reliance on cloud services and digital infrastructure fueled the need for data centers and storage solutions, while consumer electronics like laptops, tablets, and gaming consoles saw strong sales. The rollout of 5G networks further boosted demand for smartphones and network equipment. Despite early supply chain disruptions, companies quickly adapted, driving robust performance across the sector. The S&P 500 Technology Hardware, Storage, and Peripherals sub-industry index generated 76% returns in 2020.

2019 - Semiconductor Equipment and Material

In 2019, Semiconductor Equipment and Materials stocks outpaced the market, driven by multiple tailwinds. The semiconductor industry rebounded from an inventory correction, spurring renewed demand for production. The global rollout of 5G, along with the rapid growth of AI and data centers, heightened the need for advanced chips, fueling substantial investments in equipment. Trade tensions between the U.S. and China also accelerated investments in localized semiconductor manufacturing. Furthermore, technological advancements, like the move toward smaller chip sizes, increased demand for specialized semiconductor equipment, solidifying the sector’s leading position in the market. The S&P 500 Semiconductor Equipment and Materials sub-industry index produced returns of 102% in 2019.

2018 - Independent Power Producer

In 2018, Independent Power Producer stocks performed well due to the growing demand for renewable energy and favorable tax incentives, such as the Production Tax Credit (PTC) and Investment Tax Credit (ITC). Many Independent Power producers benefited from long-term power purchase agreements (PPAs) with corporations, providing stable revenue streams. Additionally, strong earnings reports and a robust pipeline of renewable projects boosted investor confidence. Low interest rates helped Independent Power Producer finance capital-intensive projects more easily, further supporting growth. Amid market volatility, Independent Power Producer stocks were seen as defensive investments due to their stable cash flows. In 2018, the S&P 500 Independent Power Producer and Energy Traders sub-industry index generated 39%.

2017 - Casinos and Gaming

In 2017, casinos and gaming stocks were big winners due to strong global economic growth, boosting consumer spending on entertainment. Macau's gaming industry rebounded, driving up the stock prices of companies like Wynn Resorts and Las Vegas Sands. U.S. tax reform optimism, particularly corporate tax cuts, fueled investor confidence in domestic gaming companies. The rise of online gaming and potential regulatory changes also attracted attention from investors. Additionally, merger and acquisition activity, along with Las Vegas's strong recovery, contributed to the sector's impressive gains. In 2017, the S&P 500 Casinos and Gaming sub-industry index won big with gains of 74%.

2016 - Gold Mining

Gold Mining stocks shined in 2016. Gold Mining stocks performed well due to rising gold prices, driven by increased demand for safe-haven assets amidst global economic uncertainty. The U.S. Federal Reserve's low-interest rate policy made holding gold more attractive, boosting its value. Geopolitical events like Brexit and the U.S. election heightened risk aversion, further increasing gold's appeal. A weaker U.S. dollar also contributed, making gold cheaper for international buyers and driving up demand. Positive investor sentiment toward gold mining companies led to significant capital inflows, amplifying stock performance. The S&P 500 Gold Mining sub-industry index produced returns of 90% in 2016.

2015 - Internet Retail

In 2015, internet retailer stocks surged as more consumers shifted to online shopping due to its convenience and accessibility. Advances in mobile technology and payment systems made it easier to shop via smartphones and tablets, fueling growth. E-retailers also invested heavily in logistics and delivery infrastructure, improving efficiency and customer satisfaction. Major companies like Amazon and Alibaba expanded their dominance, while smaller online retailers gained market share. Favorable economic conditions, including low interest rates and strong consumer confidence, boosted investor optimism and drove stock prices higher. With the consumer building a strong connection to Internet retailers, the S&P 500 Internet and Catalog sub-industry index generated 83% returns in 2015.

2014 - Home Entertainment Software

In 2014, the S&P 500 Home Entertainment Software sub-industry index delivered stellar returns, soaring by 105% as it led the market. The shift from physical game sales to digital downloads significantly boosted profitability, while the rise of mobile gaming—fueled by hits like Candy Crush and Clash of Clans—drove new revenue streams through microtransactions. The release of next-gen consoles like the PlayStation 4 and Xbox One increased demand for new games, benefiting companies across the sector. Blockbuster franchises like Call of Duty and Grand Theft Auto posted strong sales, further elevating stock prices. Additionally, the growing popularity of eSports and online gaming heightened user engagement and in-game monetization, contributing to the sector's remarkable performance.